NCAA Tournament (Henderson’s Version) Takes Action at 2024 Annual Meeting

Tournament Litigation with Tastykake over 2013 Snack Bar Incident Settled

(Cannon Beach, Oregon) – Despite record inflation and crippling debt, senior Henderson NCAA Tournament Officials gathered – at participant dues’ expense – at the Inn at Cannon Beach in late January for its annual Board of Directors meeting and Silent Auction. As always, proceeds from the silent auction benefited the Hawaii Tsunami Relief Fund.

Key actions taken by the Board:

- Voted to retain Ron Burgundy and Associates to defend Tournament Officials from a

Air Supply Performed at the Annual Dinner and Silent Auction

pending IRS tax fraud investigation. “Frankly, since we’ve never filed tax returns, we don’t know what they’re looking at,” said Matt Henderson, Tournament President, who requested anonymity to speak candidly on the matter.

- Disclosed that no college athletes chose to engage the Henderson NCAA Tournament for Name, Image and Likeness sponsorships. “We’re still within our market growth projections,” said Senior Vice President for Marketing, Promotion, Benefit Administration, Climate and Environmental Justice, Diversity, Equity, Inclusion and Pronoun Management Patrick Henderson.

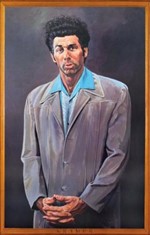

Director Kramer

- Named Cosmo Kramer as Senior Director for Midwest Basketball Operations. “It’s been a challenge to fill this position. Quality candidates are hard to come by,” said a Tournament spokesperson who also serves as the Deputy Director for Midwest Basketball Operations.

- Terminated the contract of Patrick Henderson as Senior Vice President for Marketing, Promotion, Benefit Administration, Climate and Environmental Justice, Diversity, Equity, Inclusion and Pronoun Management. “No. Just no. We don’t play these games anymore,” said President Matt Henderson. He also cited excessive costs related to business card printing as a contributing factor.

- Purchased, at $200,000 above prevailing market prices, carbon offset credits from A Green New Deal, Inc., which is a wholly owned subsidiary of Henderson Enterprises, LLC.